By: Javid Amin

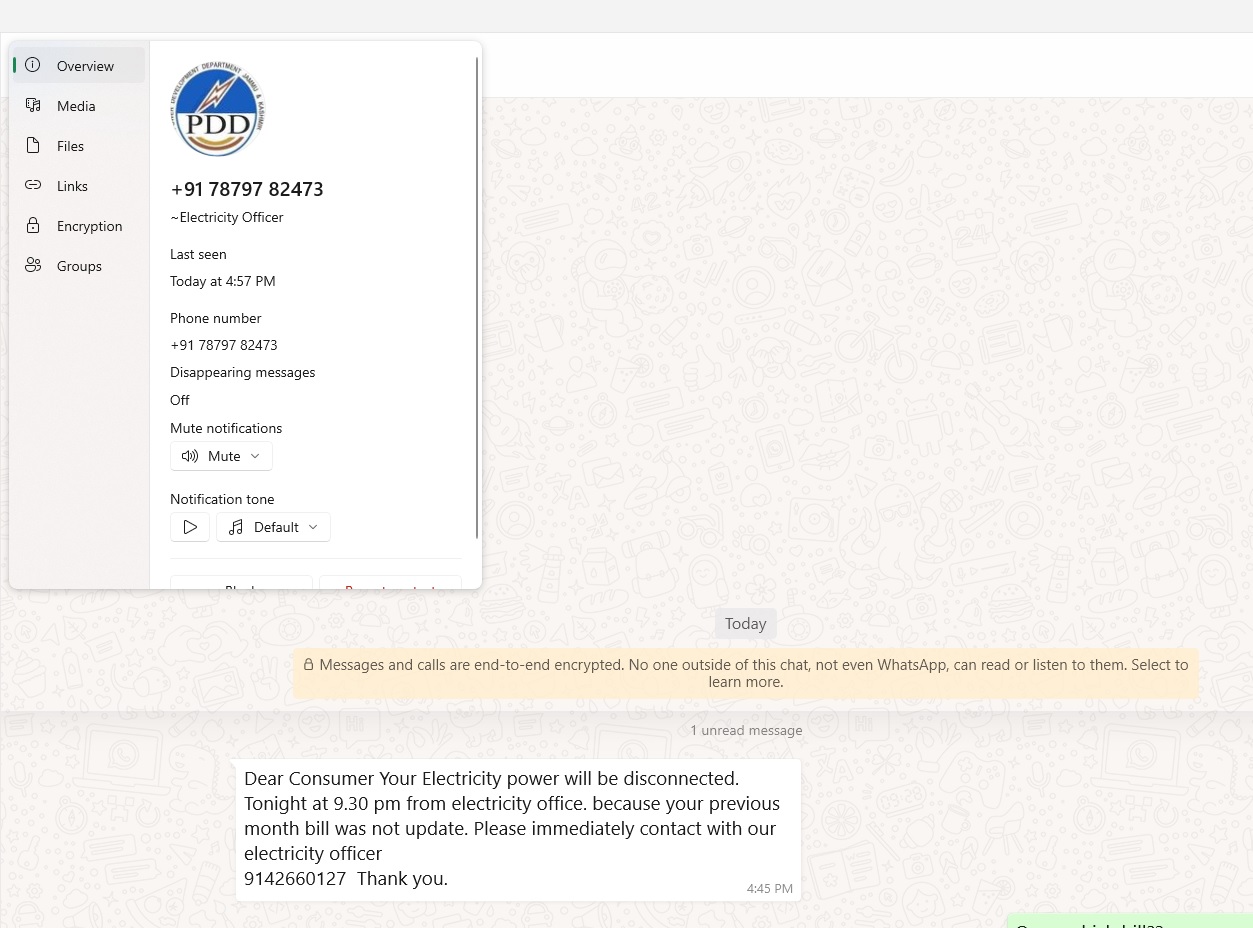

Deceptive tactics targeting individuals have become increasingly sophisticated, and the realm of utility bill payments is no exception. “PDD Fraud,” characterized by misleading messages claiming imminent disconnection due to unpaid bills, seeks to exploit anxiety and pressure individuals into making false payments. This article empowers you with the knowledge and practical steps to safeguard yourself and your community from such scams.

Understanding the Mechanics of PDD Fraud: These fraudulent messages exploit fear and exploitations in digital literacy. Perpetrators often impersonate legitimate organizations like your local electricity provider (Power Distribution Department or PDD) to lend credibility to their deception. Key tactics include:

- Urgency: Emphasizing immediate action with threats of disconnection, claiming your bill is overdue.

- False Authority: Displaying fake logos or claiming to be representatives of your PDD.

- Phishing Links: Embedding links leading to malicious websites designed to steal personal or financial information.

- Unusual Payment Methods: Demanding immediate payment through untraceable means like online wallets or prepaid cards.

Proactive Measures for Individual Protection:

-

Verification is Paramount:

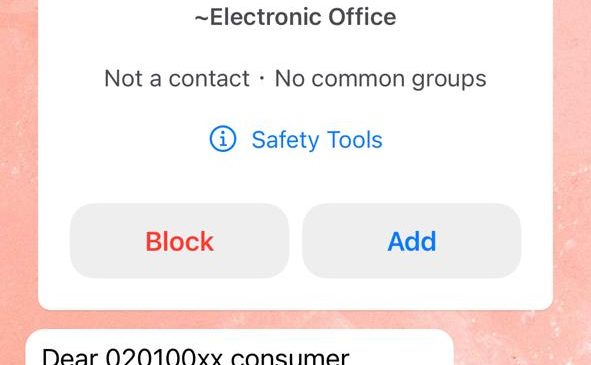

- Never react immediately to unsolicited messages demanding payment.

- Directly contact your PDD using official phone numbers or websites. Avoid contact information provided in the message itself.

- Verify your bill status through the official PDD website or app. Most offer online bill management and secure payment options.

-

Identifying Red Flags:

- Misspelled words, grammatical errors, and unprofessional language are indicators of a scam.

- Generic greetings (“Dear Customer”) instead of addressing you by name raise suspicion.

- Threats and intimidating language are used to pressure quick action.

- Requests for immediate payment through unusual methods are a sure sign of fraud.

-

Safeguarding Your Information:

- Never share personal or financial information through unsolicited messages.

- Do not click on suspicious links or attachments.

- Enable two-factor authentication (2FA) for online accounts, especially payment portals.

-

Reporting and Collaboration:

- Forward scam messages to your PDD’s official reporting channels.

- Report the incident to cybercrime authorities or relevant agencies.

Collective Action for Community Resilience:

- Disseminate Awareness: Share information about PDD fraud with your network, especially vulnerable individuals.

- Engage with Your PDD: Encourage educational campaigns and initiatives to raise awareness about scams.

Empowered Consumers, Stronger Communities: PDD fraud thrives on exploiting fear and urgency. By remaining vigilant, verifying information, and reporting suspicious activity, we create a safer digital environment for ourselves and our communities.

Remember:

- Taking a few minutes to verify can save you from financial loss and security risks.

- Your PDD will never demand immediate payment through unofficial channels.

- Sharing knowledge and reporting scams empowers communities to combat fraudsters.

Additional Resources:

- Official PDD websites often have dedicated sections on customer awareness and reporting fraud.

- Cybersecurity websites and government agencies provide resources and advice on identifying and reporting online scams.